This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Households to be hit by council tax rise

21/03/2024

The average annual council tax bill will rise by £106 this year as local authorities seek to maximise revenue.

The bill for an average Band D property will increase by 5% to £2,171, with all of the 153 upper-tier councils applying some or all of the social care precept of 2%, according to statistics released by the Department for Levelling Up, Housing and Communities.

This means the overall council requirement in England is £41.2 billion, an increase of £2.5 billion on 2023/24, while average annual bills have risen by 20% since 2020/21.

There is regional variation in average council tax bills which include social care and parish precepts.

In London the average annual bill for a Band D property will be £1,422, an increase of 5% on 2023/24.

Metropolitan districts outside London will see an average annual increase of 5.4% to £1,837, while bills in unitary counties with no districts will rise 5% to £1,886.

Meanwhile, the average bill in other county areas will increase by 5% to £1,643, with districts in these areas adding an additional £266.

Councils have warned they face difficult trade-offs due to a prolonged funding squeeze across local government despite the Government recently boosting available funding by £600 million.

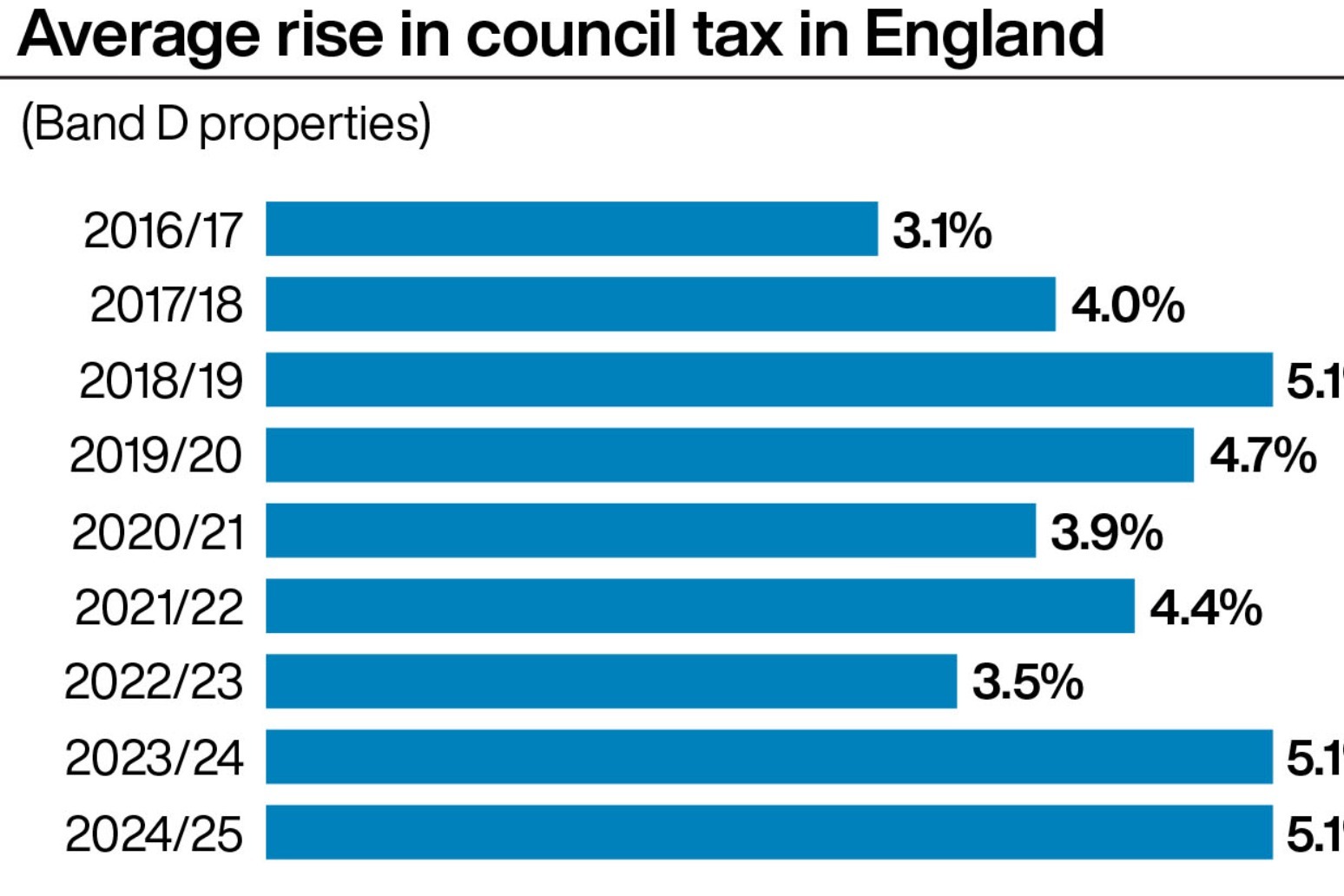

Annual council tax increases remained below 1% between 2010 and 2015, but rose to 5% for the first time in 2018/19.

Currently upper-tier councils cannot raise council tax above 4.99% including the social care precept without gaining approval from a local referendum.

Parish precepts in 2024-25 will total £783 million, which is £75 million higher than in 2023-24.

Some councils in severe financial difficulties have been granted permission by the Government to increase council tax beyond the 4.99% threshold.

Birmingham City Council has approved a 9.99% increase – taking annual bills for a Band D property to £1,793.

Earlier this month, the County Councils Network (CCN) called for an “honest discussion” on what services local authorities should be required to deliver after it emerged that councils on average spend two-thirds of their budgets on care services.

At the time, Roger Gough, Conservative leader of Kent County Council and CCN’s spokesman for children’s services, said: “This month’s Budget confirmed that the public finances remain extremely tight. Therefore we need to have an honest discussion with all main political parties as we head into the general election on what councils can reasonably be expected to deliver, in a climate where substantive extra funds are unlikely and both demand and costs are set to rise.”

Shaun Davies, Labour chairman of the Local Government Association, said councils are starting the financial year in a precarious position and scaling back or closing a wide range of services.

“This means many are again left facing the difficult choice about raising bills to bring in desperately needed funding,” he said.

“It is unsustainable to expect them to keep doing more for less in the face of unprecedented cost and demand pressures.

“Keeping councils on a financial drip feed has led to the steady weakening of local services. Local government needs greater funding certainty through multi-year settlements to prevent this ongoing decline.”

Published: by Radio NewsHub